Returns

Earn better returns than most traditional investment options.

-

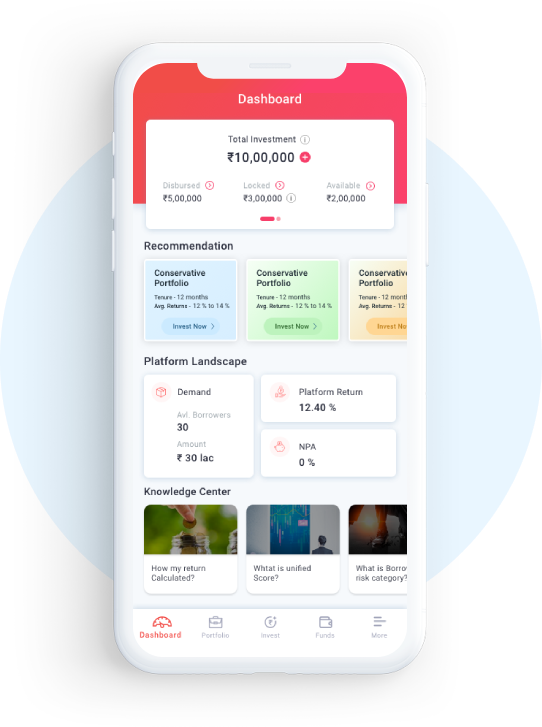

Select borrower as per your risk appetite

Independently decide how much return you want to. You can lend to borrowers starting at 12% to 36% as per your risk appetite and borrower’s creditworthiness. Your returns will be equal to the interest rate of the borrower.

-

Earn attractive returns

You can earn returns starting from 12% to 36% per annum

-

Independent interest rate agreements

Interest rate agreements are completely between lenders and borrowers across the platform.

-

Earn weighted average returns

Diversify your investment and earn weighted average of the individual loan parts