5 Reasons why to lend and borrow from 5paisa loans

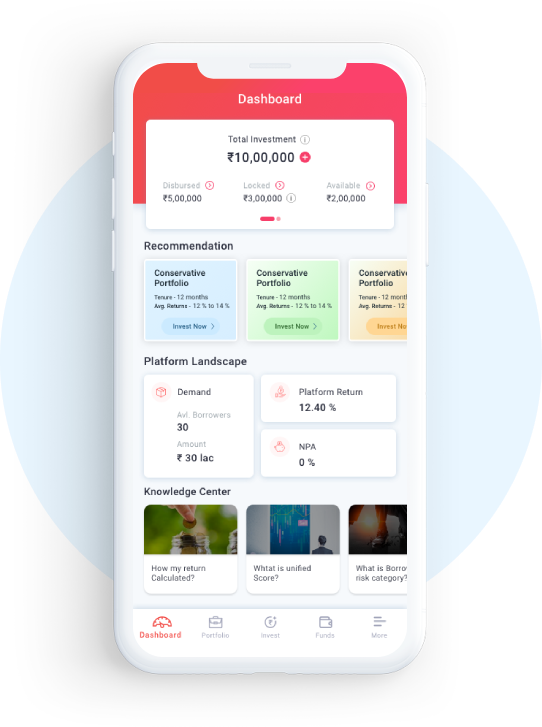

Returns upto

24% p.a.

Earn above average market

returns.

Fixed Monthly

Income

Invest and get fixed monthly income in the form of interest and principal.

Verified & Creditworthy Borrowers

We ensure strict underwriting of all borrowers registered on the platform.

Alternate investment

to diversify risk

Lend in P2P with other investment options and diversify your portfolio.

RBI approved

NBFC

We are RBI registered NBFC-P2P lending company, backed by IIFL

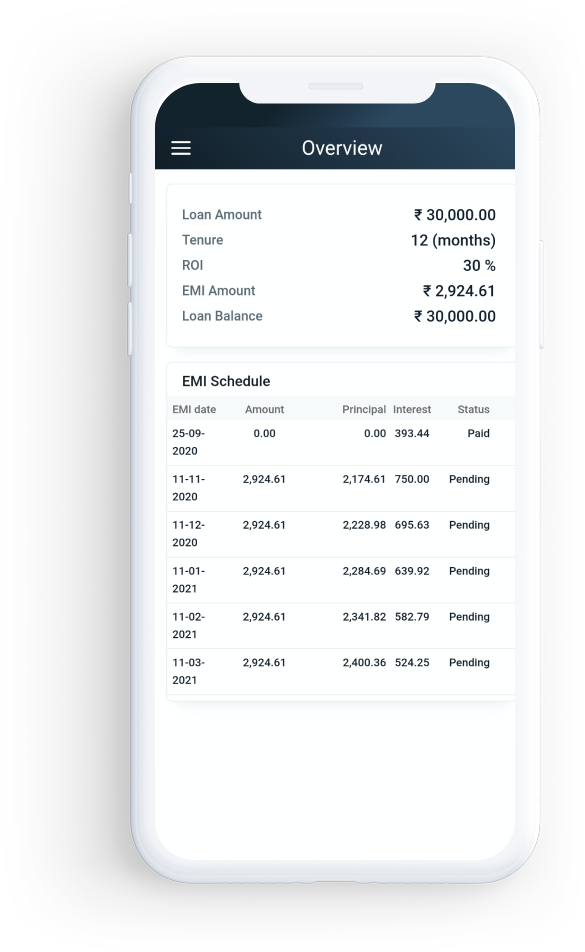

Quick and hassle-free personal loan

It’s a 4-step application process, and requires minimal documents.

Secured and completely digitised process

Create passive monthly income with regular repayments from borrowers

Interest rates starting as low as 10%

Collateral free borrowing at affordable interest rates

Save on charges

No additional charges on foreclosure.

Secured process

All your personal data is protected and confidential at all times.

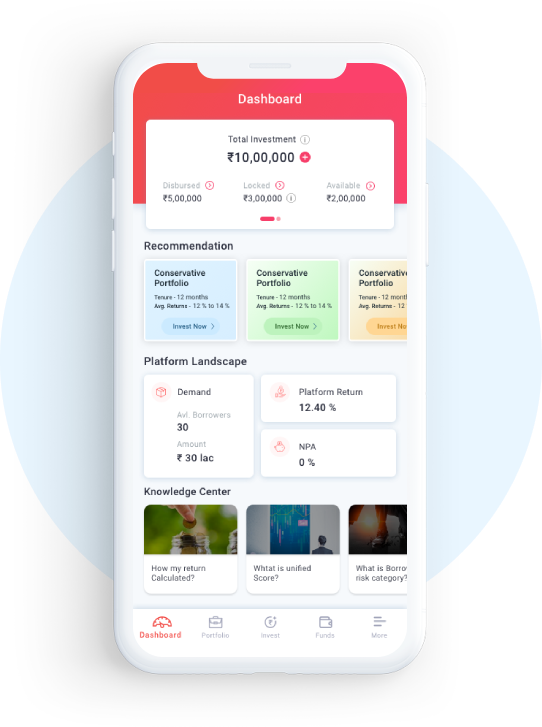

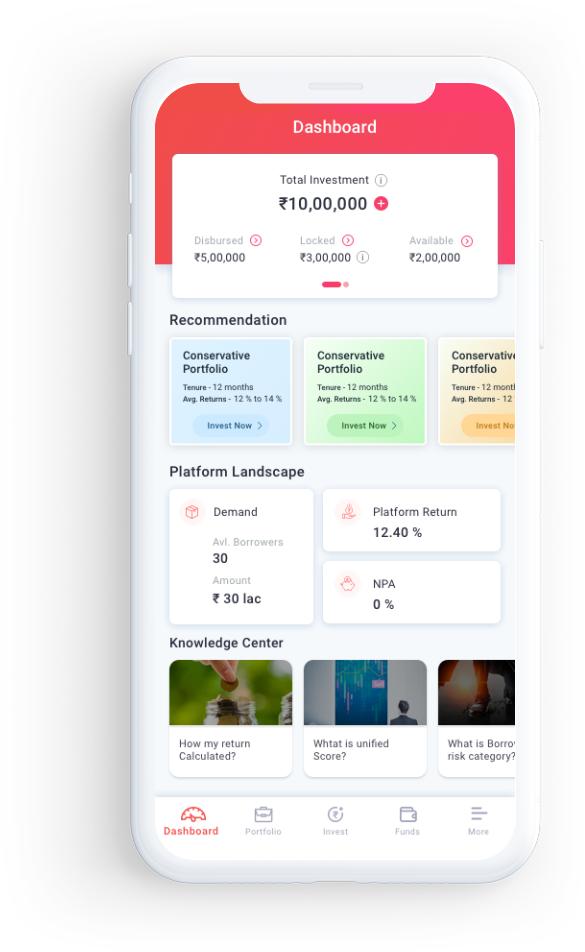

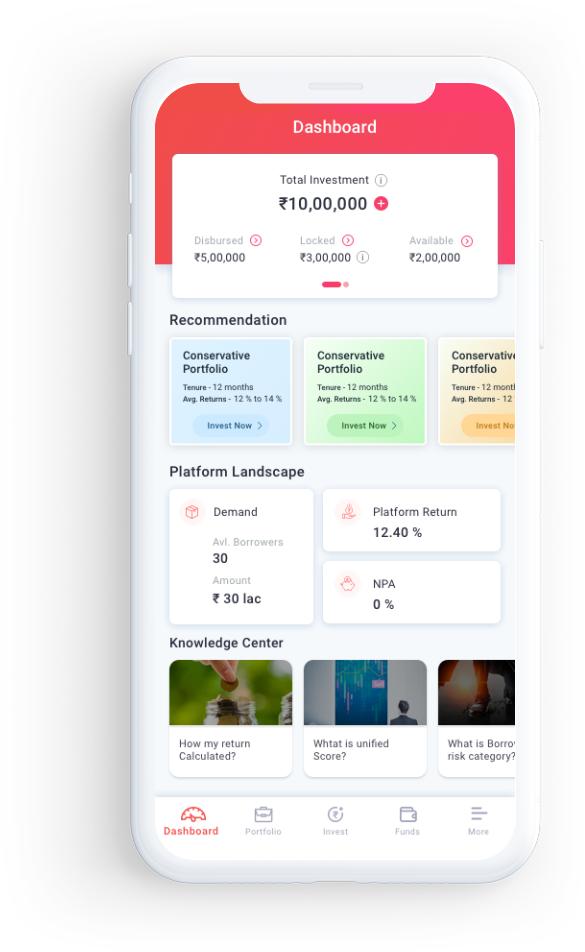

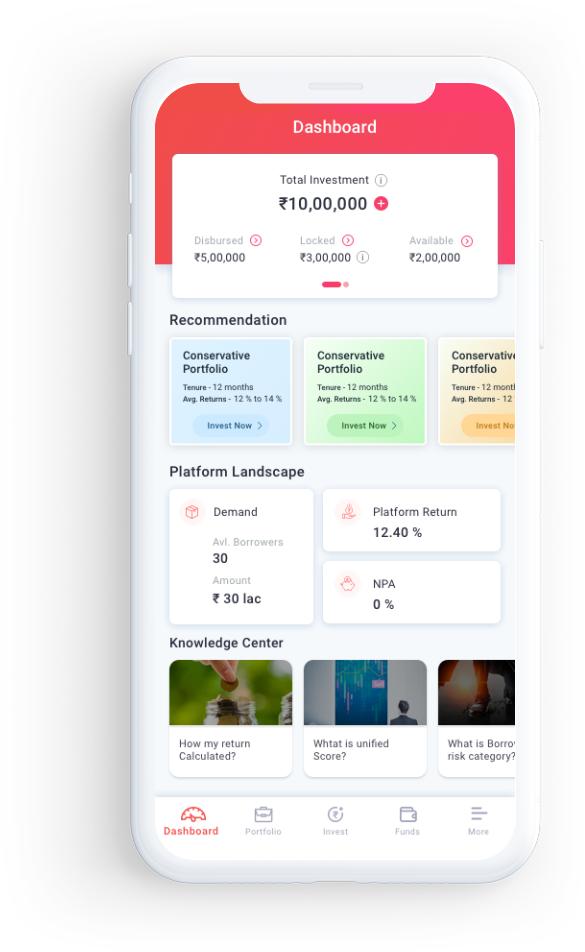

How to lend and borrow with 5paisa Loans

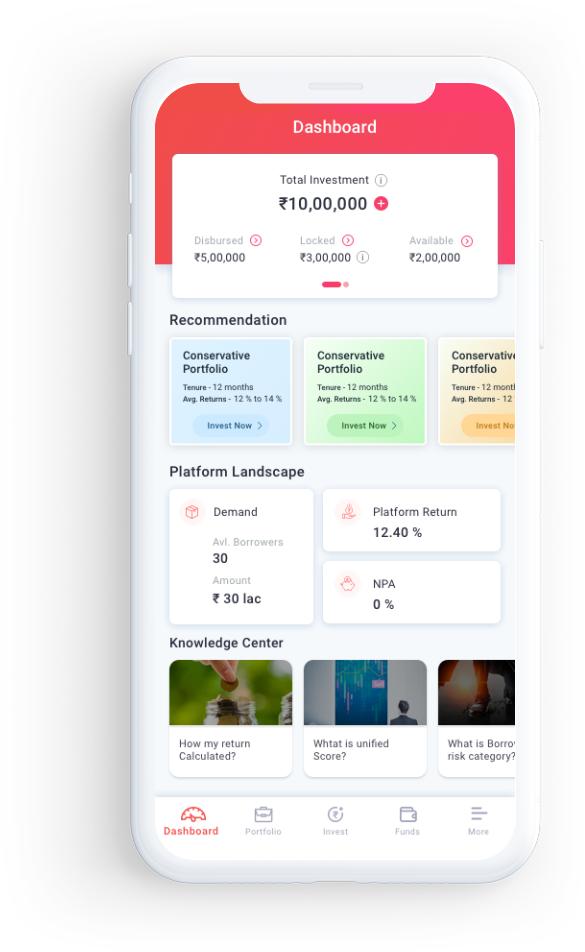

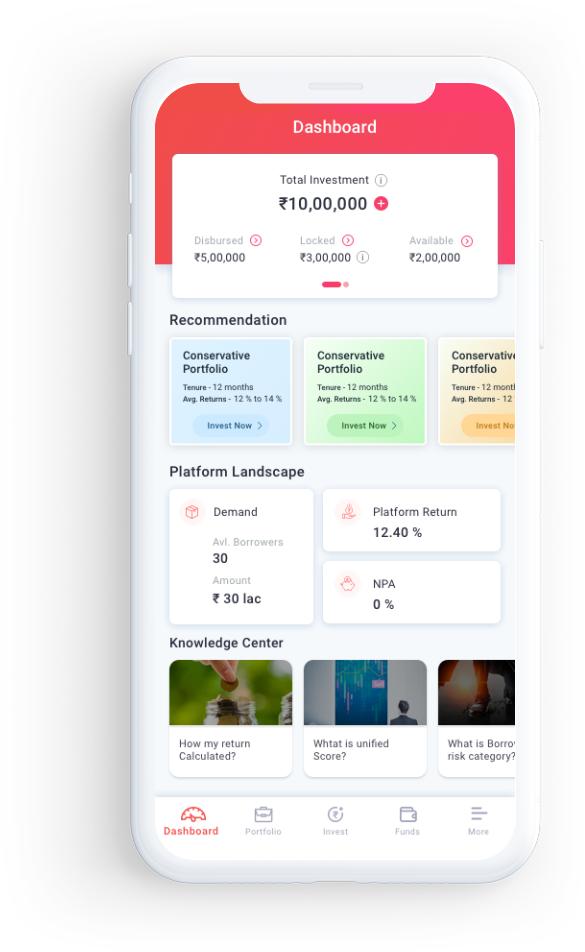

To join as a lender, you simply need to complete an online application, upload documents and add money.”

Borrowing through a peer-to-peer lending platform is quick, hassle-free, collateral free and affordable.

To join as a lender, you simply need to complete an online application, upload documents and add money.”

Register

Invest in individual

borrower that you

believe in

To join as a lender, you simply need to complete an online application, upload documents and add money.”

Upload Documents

Invest in individual

borrower that you

believe in

To join as a lender, you simply need to complete an online application, upload documents and add money.”

KYC

Invest in individual

borrower that you

believe in

To join as a lender, you simply need to complete an online application, upload documents and add money.”

Bank details

Invest in individual

borrower that you

believe in

To join as a lender, you simply need to complete an online application, upload documents and add money.”

Start Lending

Invest in individual

borrower that you

believe in

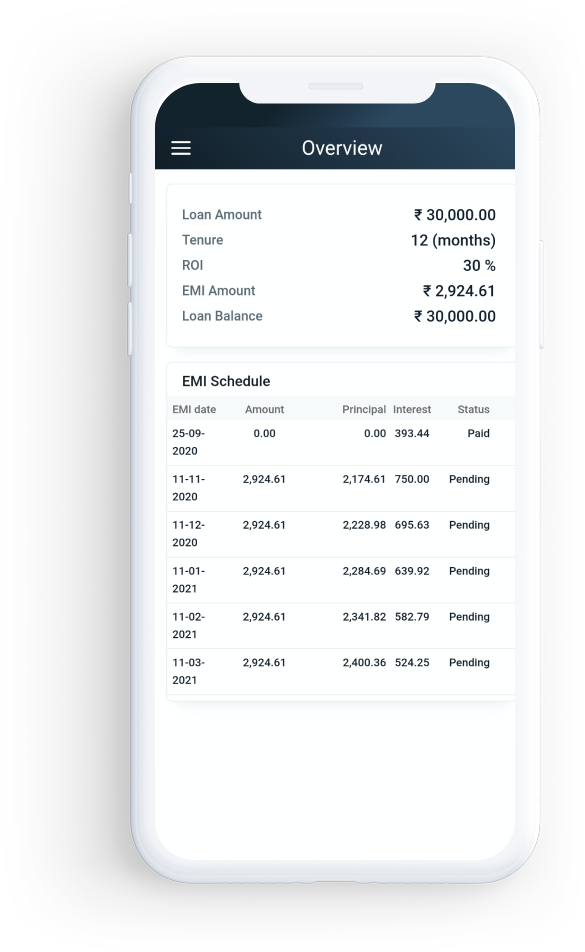

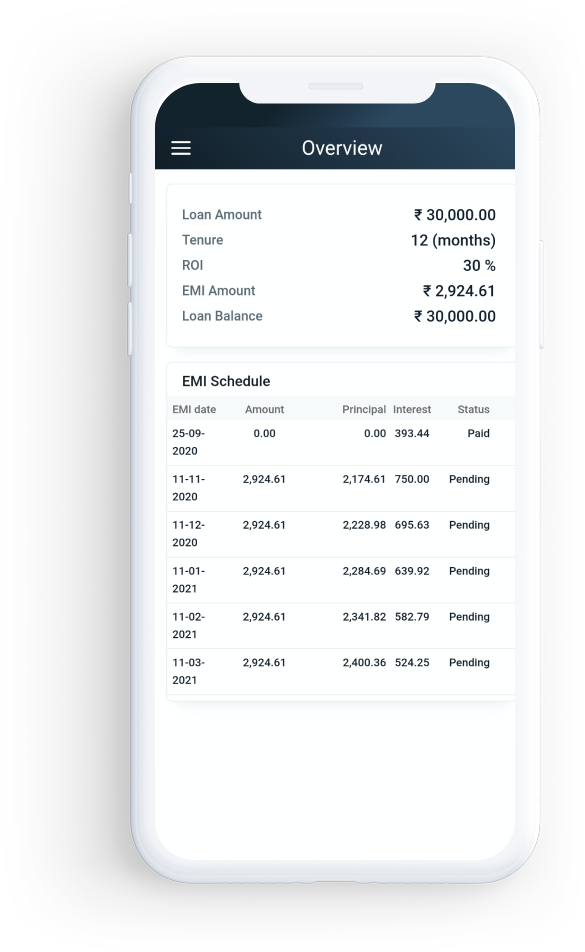

Borrowing through a peer-to-peer lending platform is quick, hassle-free, collateral free and affordable.

Register online

Invest in individual

borrower that you

believe in

Borrowing through a peer-to-peer lending platform is quick, hassle-free, collateral free and affordable.

Get verified as borrower

Invest in individual

borrower that you

believe in

Borrowing through a peer-to-peer lending platform is quick, hassle-free, collateral free and affordable.

Accept loan agreement

Invest in individual

borrower that you

believe in

Borrowing through a peer-to-peer lending platform is quick, hassle-free, collateral free and affordable.